While we expect the Inland Revenue. Who exempted from paying taxes.

Guide To Claiming The Foreign Tax Credit On Your Dividend Withholding

Capital gains tax is only applicable to gains from the sale of real properties or shares in a real.

. Double taxation on foreign dividends is not right. The calculation of individual threshold of non taxable income is taking into account after the deduction of annual gross income with eligible individual reliefs and tax rebates. Inland Revenue Board of Malaysia.

Malaysia is under the single-tier tax system. Even when a person retires and doesnt have income from a job anymore their pension and even gratuity payments are still considered part of their income. If you receive a dividend that is calculated as income youll be taxed because of the dividend earned.

Any capital gains on shares are not subject to tax under the Malaysian Income Tax Act 1967 ITA. For example if you take up a job while overseas and you only receive the payment for the job when you are back in. The tax exemption is effective from Jan 1 2022 to Dec 31 2026.

If a Malaysian REIT distributes at least 90 of its taxable income it will not be subject to corporate income tax. Instead it is conventional not to put the same income to tax twice. As such Malaysian REITs generally always pay out.

Of course there are dividends or benefits that are tax-exempt such as Tabung Haji ASB or Unit Amanah. Dividends are exempt in the hands of shareholders. Once the amendments to the Income Tax Act are passed foreign sourced income that is remitted to Malaysia by Malaysian residents individuals and corporates would be subject to tax starting from 1 January 2022.

Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available for offset against the recipients tax liability. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. 14 Income remitted from outside Malaysia.

The following 4 types will qualify. If the 90 threshold is not met the REIT would be subjected to the prevailing corporate tax of 24. In summary the tax treatments for income of a.

Malaysia is under the single-tier tax system. Capital gains on shares are not subject to tax under the Malaysian Income Tax Act 1967 ITA. Companies are not required to deduct tax from dividends paid to shareholders and no tax credits will be available.

Here are 5 tax exempted incomes that can easily apply to you. KUALA LUMPUR 30 Dis The government has agreed to exempt taxation on foreign source income FSI for resident taxpayers to ensure the smooth implementation of the tax initiative said the Ministry of Finance MoF. Such income will be treated equally vis-à-vis income accruing in or derived from Malaysia and taxable under Section 3 of the ITA.

If employers provide loans to the employees there will be tax on the interest. Subject to Inland Revenue Board criteria and guidelines income tax exemption. Mentioned below is the list of.

What kind of income is not taxable in Malaysia. One of the most significant proposed changes to our tax system is imposition of tax on foreign sourced income. Double taxation is a crime.

Two different important conditions affect a Malaysian REITs tax treatment. All classes of income received by resident individuals will be exempted by 2026. Dividends distributed by a company is taxed at the companys level as a final tax.

Corporate shareholders receiving exempt single-tier dividends can. The following foreign-sourced income received will continue to be exempted from Malaysian income tax from 1 January 2022 to 31 December 2026 5 years Dividend income received by resident companies and limited liability partnerships will be exempted to 2026. Hence dividend yields are exempted from tax in the hands of the.

Tax concerns for investments in Malaysia - especially for emerging investment vehicles. While income is taxable in Malaysia capital gains on shares are not subject to tax. Well not legally a crime.

The law currently exempts local dividends from income tax due to the single-tier system that Malaysia adopts. The tax exemption would allow individual taxpayers to remit their income back to Malaysia tax-free and encourage them to continue to do so. Income tax exemption on dividends will be granted to companies and Limited Liability Partnerships while individuals will be tax-exempted for all types of income including dividend income.

However if the trading activity of the shares is sufficiently frequent the Malaysian Revenue Board IRB may treat the profit as a gain on taxable income. Individuals who earn an annual employment income of more than RM34000 and has a Monthly tax Deduction MTD is eligible to be taxed. Effectively income tax will be imposed on resident persons in Malaysia on income derived from foreign sources and received in Malaysia with effect from 1 January 2022.

Dividends from exempt accounts of companiesDividends from co-operative societies such as the Koperasi Polis Diraja Malaysia Berhad Dividends from units trusts approved by the Minister of Finance like Amanah Saham Bumiputera. Under the Malaysian Income Tax Act 1967 the government does not impose a tax on any profits or gains deriving from any price increase when you sell a stock. Dividends are exempt in the hands of shareholders.

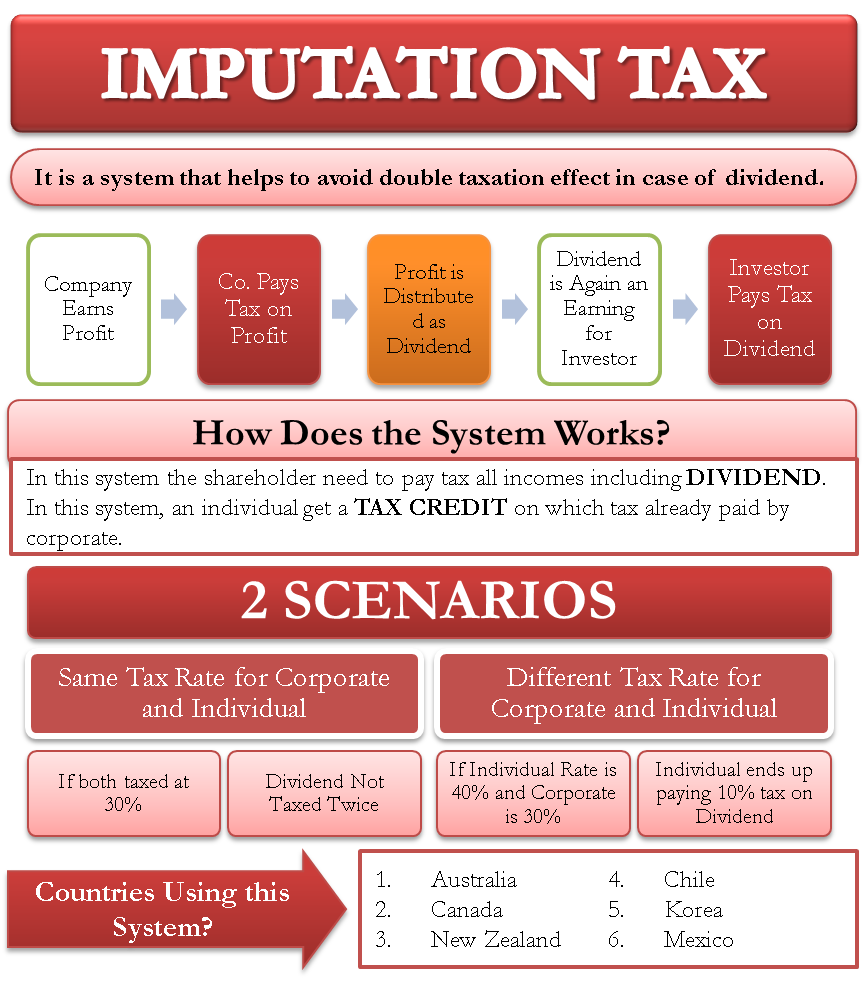

In January 2008 a single-tier system replaced the imputation system.

Taxation Of Dividend Income And Capital Gains

Taxation Principles Dividend Interest Rental Royalty And Other So

A Complete Guide For Investors On Tax On Dividend Income Ebizfiling

If I Reinvest My Dividends Are They Still Taxable

Chapter 5 Non Business Income Students

The Top One Percent Net Worth Levels By Age Group Passive Income Investing Spending Problem

Dividend And Growth Investing And What Are Dividends Dividend Magic

Dividend Withholding Tax Rates By Country For 2022 Topforeignstocks Com

11 Things You Need To Know About Dividends

Preferred Dividend Definition Formula How To Calculate

Best Premier Banking In Malaysia Dividend Magic Banking Relationship Management Dividend

Taxation Of Dividend Income And Capital Gains

Treatment Of Dividends In Different Countries Download Table

Imputation Tax Meaning How It Works And More

Infographic Stocks Vs Bonds Financial Bonds Infographic Bond

A Review Of Capbay P2p Lending In Malaysia Dividend Magic P2p Lending Dividend Types Of Loans

10 Things Nri Should Know About Portfolio Investment Scheme Pis Nri Saving And Investment Tips Investing Investment Tips Savings And Investment

Taxation Principles Dividend Interest Rental Royalty And Other So